2021 UPDATE

- previous updates and original article below

Trustees Again Warn Social Security and Medicare Are in Trouble

by Potomac Tea Party

September 2021

The Democrats want to add trillions in new spending and expand Medicare, but Americans should know our existing social insurance programs are in deep trouble.

The latest Trustee reports show Social Security will be unable to pay full benefits a year earlier than previously projected and Medicare insolvency is only five years away. These projections are under mid-range assumptions. Things could be better or they could be worse.

The Trustees are appointed by the federal government to assess the health of these programs. They estimate Medicare will be insolvent in 2026 and Social Security will follow in 2033. Costs are rising faster than revenues, revenues being payroll taxes, individual premiums, and interest on the so-called trust funds. Insolvency isn’t the same as bankruptcy. You can operate at a loss for a while before going bankrupt.

A senator said Social Security benefits will have to go down 25 percent when the program becomes insolvent. Another observer said the choice for Social Security is either a 21 percent benefit cut or a 27 percent tax hike. The longer the country waits to deal with the problem, the harder it becomes to fix, the Trustees said again, as they always do.

Highlights from the Trustees 2021 Medicare Report indicate expenditures for the Hospital Insurance (HI) portion of Medicare exceeded total income in 2020 and the program is under-financed for the next 10 years. The Trustees expect a small surplus in 2022 but deficits thereafter until the so-called ‘trust funds’ are depleted in 2026.

It’s important to point out there are no real Social Security or Medicare trust funds. People think the money was set aside, but the money was spent long ago. There’s nothing in the trust fund accounts but government IOUs. The upshot is these are essentially pay-as-you go programs.

We get similar warnings from the Trustees every year, but the warnings never seem to make any difference in people’s lives or get Congress to do anything about the problem. That’s because it doesn’t hurt bad enough yet. I attended every meeting of the Kerrey-Danforth Entitlement Commission in the ‘90s. The programs were in trouble even then. The wisest thing that was said was ‘ain’t nothing gonna happen until there’s a crisis.’ In other words, we will not summon the political will to fix anything until then. Here it is almost 30 years later, and the observation is still true.

There’s no shortage of proposed fixes, starting with raising the retirement age. When Social Security was instituted, people lived an average 61 years. Life expectancy has increased 17 years since then, making the program unsustainable on the face of things. Another reform proposal is to give people the option to put a portion of their payroll taxes into a private account. Research shows private accounts would generate higher retirement payouts, despite the ups and downs of the market.

Medicare is the bigger problem and there aren’t any easy fixes. But two things are certain: a crisis will be upon us in five years if nothing is done, and the Democrats’ current proposals to lower the eligibility age and expand Medicare benefits will only make things worse. Those proposals are completely reckless and should not even be considered until problems with the existing programs are fixed.

More here:

- Trustees 2021 Social Security Report

- Trustees 2021 Medicare Report

- previous updates and original article below

Trustees Again Warn Social Security and Medicare Are in Trouble

by Potomac Tea Party

September 2021

The Democrats want to add trillions in new spending and expand Medicare, but Americans should know our existing social insurance programs are in deep trouble.

The latest Trustee reports show Social Security will be unable to pay full benefits a year earlier than previously projected and Medicare insolvency is only five years away. These projections are under mid-range assumptions. Things could be better or they could be worse.

The Trustees are appointed by the federal government to assess the health of these programs. They estimate Medicare will be insolvent in 2026 and Social Security will follow in 2033. Costs are rising faster than revenues, revenues being payroll taxes, individual premiums, and interest on the so-called trust funds. Insolvency isn’t the same as bankruptcy. You can operate at a loss for a while before going bankrupt.

A senator said Social Security benefits will have to go down 25 percent when the program becomes insolvent. Another observer said the choice for Social Security is either a 21 percent benefit cut or a 27 percent tax hike. The longer the country waits to deal with the problem, the harder it becomes to fix, the Trustees said again, as they always do.

Highlights from the Trustees 2021 Medicare Report indicate expenditures for the Hospital Insurance (HI) portion of Medicare exceeded total income in 2020 and the program is under-financed for the next 10 years. The Trustees expect a small surplus in 2022 but deficits thereafter until the so-called ‘trust funds’ are depleted in 2026.

It’s important to point out there are no real Social Security or Medicare trust funds. People think the money was set aside, but the money was spent long ago. There’s nothing in the trust fund accounts but government IOUs. The upshot is these are essentially pay-as-you go programs.

We get similar warnings from the Trustees every year, but the warnings never seem to make any difference in people’s lives or get Congress to do anything about the problem. That’s because it doesn’t hurt bad enough yet. I attended every meeting of the Kerrey-Danforth Entitlement Commission in the ‘90s. The programs were in trouble even then. The wisest thing that was said was ‘ain’t nothing gonna happen until there’s a crisis.’ In other words, we will not summon the political will to fix anything until then. Here it is almost 30 years later, and the observation is still true.

There’s no shortage of proposed fixes, starting with raising the retirement age. When Social Security was instituted, people lived an average 61 years. Life expectancy has increased 17 years since then, making the program unsustainable on the face of things. Another reform proposal is to give people the option to put a portion of their payroll taxes into a private account. Research shows private accounts would generate higher retirement payouts, despite the ups and downs of the market.

Medicare is the bigger problem and there aren’t any easy fixes. But two things are certain: a crisis will be upon us in five years if nothing is done, and the Democrats’ current proposals to lower the eligibility age and expand Medicare benefits will only make things worse. Those proposals are completely reckless and should not even be considered until problems with the existing programs are fixed.

More here:

- Trustees 2021 Social Security Report

- Trustees 2021 Medicare Report

2019 UPDATE

- previous updates and original article below

Social Security and Medicare Still in Actuarial Deficit on a Long-Term Basis

by Potomac Tea Party

May 2019

The 2019 Social Security Trustees report from the government repeats what has been known for years: Social Security is actuarially unsound and therefore unsustainable in the long term. To be fully solvent throughout the next 75 years, payroll taxes would have to be raised by 2.70 percentage points, or benefits would have to be cut 17 percent, or some combination of payroll taxes and benefit cuts would have to be adopted. This assumes lawmakers act right away. The fixes get harder the longer they wait. Also, Social Security is currently adding to the deficit. Only ‘interest’ from phony ‘trust funds’ that have already been spent allows the government to maintain the fiction that Social Security’s total income exceeds current program costs. But the jig is up. This is the last year, according to the Trustees, that the fiction can be maintained.

The Medicare Trustees reported equally dismal findings. The Medicare HI actuarial deficit is increasing, and expenditures are expected to exceed revenues in all future years. As usual, the Trustees say that changes to the program are needed sooner rather than later.

Highlights from the 2019 Trustees Report

Highlights from the 2019 Medicare Trustees Report

- previous updates and original article below

Social Security and Medicare Still in Actuarial Deficit on a Long-Term Basis

by Potomac Tea Party

May 2019

The 2019 Social Security Trustees report from the government repeats what has been known for years: Social Security is actuarially unsound and therefore unsustainable in the long term. To be fully solvent throughout the next 75 years, payroll taxes would have to be raised by 2.70 percentage points, or benefits would have to be cut 17 percent, or some combination of payroll taxes and benefit cuts would have to be adopted. This assumes lawmakers act right away. The fixes get harder the longer they wait. Also, Social Security is currently adding to the deficit. Only ‘interest’ from phony ‘trust funds’ that have already been spent allows the government to maintain the fiction that Social Security’s total income exceeds current program costs. But the jig is up. This is the last year, according to the Trustees, that the fiction can be maintained.

The Medicare Trustees reported equally dismal findings. The Medicare HI actuarial deficit is increasing, and expenditures are expected to exceed revenues in all future years. As usual, the Trustees say that changes to the program are needed sooner rather than later.

Highlights from the 2019 Trustees Report

- OASDI -Total income was $1,003 billion, which consisted of $920 billion in non-interest income and $83 billion in interest earnings.... Under the Trustees’ intermediate assumptions, Social Security’s total cost is projected to be less than its total income in 2019 and higher than its total income in 2020 and all later years. Social Security’s cost has exceeded its non-interest income since 2010. For 2019, program cost is projected to be less than total income by about $1 billion and exceed non-interest income by about $81 billion.... Under the Trustees’ intermediate assumptions, OASDI cost is projected to exceed total income starting in 2020, and the dollar level of the hypothetical combined trust fund reserves declines until reserves become depleted in 2035..... For the 75-year projection period, the actuarial deficit is 2.78 percent of tax-able payroll, decreased from 2.84 percent of taxable payroll in last year’s report.... To illustrate the magnitude of the 75-year actuarial deficit, consider that for the combined OASI and DI Trust Funds to remain fully solvent throughout the 75-year projection period: (1) revenue would have to increase by an amount equivalent to an immediate and permanent payroll tax rate increase of 2.70 percentage points1 to 15.10 percent, (2) scheduled benefits would have to be reduced by an amount equivalent to an immediate and permanent reduction of about 17 percent applied to all current and future beneficiaries.... Under the intermediate assumptions, the projected hypothetical combined OASI and DI Trust Fund asset reserves become depleted and unable to pay scheduled benefits in full on a timely basis in 2035....

Highlights from the 2019 Medicare Trustees Report

- For the 75-year projection period, the HI actuarial deficit has increased to 0.91 percent of taxable payroll from 0.82percent in last year’s report.

- The Board projects that expenditures will increase in future years at a faster pace than either aggregate workers’ earnings or the economy overall and that, as a percentage of GDP, they will increase from 3.7percentin 2018 to 6.5percentby 2093 (based on the Trustees’ intermediate set of assumptions).

- The Trustees project that HI tax income and other dedicated revenues will fall short of HI expenditures in all future years. The HI trust fund does not meet either the Trustees’ test of short-range financial adequacy or their test of long-range close actuarial balance.

- The financial projections in this report indicate a need for substantial changes to address Medicare’s financial challenges. The sooner solutions are enacted, the more flexible and gradual they can be.

2018 UPDATE

Social Security and Medicare Trustees Issue Yet Another Warning

by Potomac Tea Party

June 2018

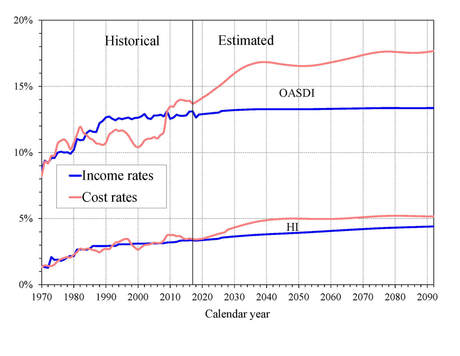

The Trustees project that Social Security’s trust fund will be depleted in 2034, unchanged from last year. However, the Medicare HI trust fund will be depleted in 2026, three years earlier than in last year’s report. It remains true for both Social Security and Medicare that program expenditures exceed payroll taxes. You have to believe in the ‘trust funds’ – IOUs where the money has already been spent – to claim that Social Security and Medicare are in any way solvent. But no matter how you slice it, they are actuarially unsound on a long term basis. You can see from Chart B below that payroll taxes are not expected to cover the cost of these programs, ever. Clearly, the path we are on is unsustainable.

Highlights from the 2018 Trustees Report:

Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.

Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.

Social Security

The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year’s report. The projected 75-year actuarial deficit for the OASDI Trust Funds is 2.84 percent of taxable payroll, up slightly from 2.83 percent projected in last year’s report.

In 2017, Social Security’s total income exceeded total cost by $44 billion, but when interest received on trust fund assets is excluded from program income, there was a deficit of $41 billion. The Trustees now project that total cost will exceed total income (including interest) beginning in 2018 and continuing throughout the long-range period (2018-92).

Medicare

The Trustees project that the HI Trust Fund will be depleted in 2026, three years earlier than projected in last year’s report.

The Trustees project that total Medicare costs (including both HI and SMI expenditures) will grow from approximately 3.7 percent of GDP in 2017 to 5.8 percent of GDP by 2038, and then increase gradually thereafter to about 6.2 percent of GDP by 2092.

In 2017, the HI Trust Fund’s total income, consisting of $292 billion in non-interest income and $7 billion in interest income (Table 3), exceeded program expenditures ($297 billion). The Trustees project that HI tax income and other dedicated revenues will fall short of expenditures in all future years.

What is the Outlook for Future Social Security and Medicare HI Costs and Income in Relation to Taxable Earnings? Because the primary source of income for OASDI and HI is the payroll tax, it is informative to express the programs’ incomes and costs as percentages of taxable payroll—that is, of the base of worker earnings taxed to support each program (Chart B).

Chart B—OASDI and HI Income and Cost as Percentages of Their Respective Taxable Payrolls

Social Security and Medicare Trustees Issue Yet Another Warning

by Potomac Tea Party

June 2018

The Trustees project that Social Security’s trust fund will be depleted in 2034, unchanged from last year. However, the Medicare HI trust fund will be depleted in 2026, three years earlier than in last year’s report. It remains true for both Social Security and Medicare that program expenditures exceed payroll taxes. You have to believe in the ‘trust funds’ – IOUs where the money has already been spent – to claim that Social Security and Medicare are in any way solvent. But no matter how you slice it, they are actuarially unsound on a long term basis. You can see from Chart B below that payroll taxes are not expected to cover the cost of these programs, ever. Clearly, the path we are on is unsustainable.

Highlights from the 2018 Trustees Report:

Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.

Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.

Social Security

The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year’s report. The projected 75-year actuarial deficit for the OASDI Trust Funds is 2.84 percent of taxable payroll, up slightly from 2.83 percent projected in last year’s report.

In 2017, Social Security’s total income exceeded total cost by $44 billion, but when interest received on trust fund assets is excluded from program income, there was a deficit of $41 billion. The Trustees now project that total cost will exceed total income (including interest) beginning in 2018 and continuing throughout the long-range period (2018-92).

Medicare

The Trustees project that the HI Trust Fund will be depleted in 2026, three years earlier than projected in last year’s report.

The Trustees project that total Medicare costs (including both HI and SMI expenditures) will grow from approximately 3.7 percent of GDP in 2017 to 5.8 percent of GDP by 2038, and then increase gradually thereafter to about 6.2 percent of GDP by 2092.

In 2017, the HI Trust Fund’s total income, consisting of $292 billion in non-interest income and $7 billion in interest income (Table 3), exceeded program expenditures ($297 billion). The Trustees project that HI tax income and other dedicated revenues will fall short of expenditures in all future years.

What is the Outlook for Future Social Security and Medicare HI Costs and Income in Relation to Taxable Earnings? Because the primary source of income for OASDI and HI is the payroll tax, it is informative to express the programs’ incomes and costs as percentages of taxable payroll—that is, of the base of worker earnings taxed to support each program (Chart B).

Chart B—OASDI and HI Income and Cost as Percentages of Their Respective Taxable Payrolls

2017 UPDATE

Social Security and Medicare Still in the Red on a Cash Flow Basis

Bottom Line: Social Security and Medicare are both still in the red on an annual cash flow basis and expected to stay there, thus adding to the deficit. All the happy-talk about ‘trust funds’ making up the shortfall is delusional because the ‘trust funds’ were spent a long time ago. What is remarkable in 2017 is the serious consideration of the proposal for a new entitlement – family leave – when we can’t even pay for the entitlements we already have.

Highlights from the 2017 Trustees Report:

Social Security

“Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.”

“Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.”

Social Security: “The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year's report.”

“The projected 75-year actuarial deficit for the OASDI Trust Funds is 2.83 percent of taxable payroll, up from 2.66 percent projected in last year's report.”

“…when interest income [on the trust funds] is excluded, Social Security's cost is projected to exceed its non-interest income throughout the projection period, as it has since 2010. The Trustees project that this annual non-interest deficit will average about $51 billion between 2017 and 2020. It will then rise steeply as income growth slows to its sustainable trend rate as the economic recovery is complete while the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.”

Medicare

“The Trustees project that the HI Trust Fund will be depleted in 2029, one year later than projected in last year's report. At that time dedicated revenues will be sufficient to pay 88 percent of HI costs. The Trustees project that the share of HI cost that can be financed with HI dedicated revenues will decline slowly to 81 percent in 2041, and will then rise gradually to 88 percent in 2091. The HI fund again fails the test of short-range financial adequacy, as its trust fund ratio is already below 100 percent of annual costs, and is expected to stay about unchanged to 2021 before declining in a continuous fashion until reserve depletion in 2029.”

“… the projections indicate that Medicare still faces a substantial financial shortfall….”

Social Security and Medicare Still in the Red on a Cash Flow Basis

Bottom Line: Social Security and Medicare are both still in the red on an annual cash flow basis and expected to stay there, thus adding to the deficit. All the happy-talk about ‘trust funds’ making up the shortfall is delusional because the ‘trust funds’ were spent a long time ago. What is remarkable in 2017 is the serious consideration of the proposal for a new entitlement – family leave – when we can’t even pay for the entitlements we already have.

Highlights from the 2017 Trustees Report:

Social Security

“Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.”

“Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.”

Social Security: “The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year's report.”

“The projected 75-year actuarial deficit for the OASDI Trust Funds is 2.83 percent of taxable payroll, up from 2.66 percent projected in last year's report.”

“…when interest income [on the trust funds] is excluded, Social Security's cost is projected to exceed its non-interest income throughout the projection period, as it has since 2010. The Trustees project that this annual non-interest deficit will average about $51 billion between 2017 and 2020. It will then rise steeply as income growth slows to its sustainable trend rate as the economic recovery is complete while the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.”

Medicare

“The Trustees project that the HI Trust Fund will be depleted in 2029, one year later than projected in last year's report. At that time dedicated revenues will be sufficient to pay 88 percent of HI costs. The Trustees project that the share of HI cost that can be financed with HI dedicated revenues will decline slowly to 81 percent in 2041, and will then rise gradually to 88 percent in 2091. The HI fund again fails the test of short-range financial adequacy, as its trust fund ratio is already below 100 percent of annual costs, and is expected to stay about unchanged to 2021 before declining in a continuous fashion until reserve depletion in 2029.”

“… the projections indicate that Medicare still faces a substantial financial shortfall….”

2016 UPDATE

Social Security and Medicare Trustees Issue Yet Another Warning

Highlights from the 2016 Trustees Report

Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.

Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.

Social Security

… when interest income is excluded, Social Security's cost is projected to exceed its non-interest income throughout the projection period, as it has since 2010. The Trustees project that this annual non-interest deficit will average about $69 billion between 2016 and 2019. It will then rise steeply….

Translation: Social Security has been in the red on a cash flow basis since 2010 and is expected to stay there. If you believe there are Social Security ‘trust funds’ and that ‘interest’ is paid on those funds, we have a bridge in Brooklyn we’d like to sell you.

Medicare

HI expenditure is projected to exceed non-interest income throughout the projection period, as it has in every year since 2008.

The Trustees project that the Medicare Hospital Insurance (HI) Trust Fund will be depleted in 2028, two years earlier than projected in last year's report.

The Trustees project that total Medicare costs (including both HI and SMI expenditures) will grow from approximately 3.6 percent of GDP in 2015 to 5.6 percent of GDP by 2040 and will increase gradually thereafter to about 6.0 percent of GDP by 2090

Translation: Medicare has been in the red on a cash flow basis since 2008 and the financial deterioration is accelerating. The whole exercise is unsustainable. Everybody knows that.

Social Security and Medicare Trustees Issue Yet Another Warning

Highlights from the 2016 Trustees Report

Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.

Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment.

Social Security

… when interest income is excluded, Social Security's cost is projected to exceed its non-interest income throughout the projection period, as it has since 2010. The Trustees project that this annual non-interest deficit will average about $69 billion between 2016 and 2019. It will then rise steeply….

Translation: Social Security has been in the red on a cash flow basis since 2010 and is expected to stay there. If you believe there are Social Security ‘trust funds’ and that ‘interest’ is paid on those funds, we have a bridge in Brooklyn we’d like to sell you.

Medicare

HI expenditure is projected to exceed non-interest income throughout the projection period, as it has in every year since 2008.

The Trustees project that the Medicare Hospital Insurance (HI) Trust Fund will be depleted in 2028, two years earlier than projected in last year's report.

The Trustees project that total Medicare costs (including both HI and SMI expenditures) will grow from approximately 3.6 percent of GDP in 2015 to 5.6 percent of GDP by 2040 and will increase gradually thereafter to about 6.0 percent of GDP by 2090

Translation: Medicare has been in the red on a cash flow basis since 2008 and the financial deterioration is accelerating. The whole exercise is unsustainable. Everybody knows that.

2015 UPDATE

Highlights from the 2015 Social Security and Medicare Boards of Trustees Annual Reports:

“Social Security’s total expenditures have exceeded non-interest income of its combined trust funds since 2010, and the Trustees estimate that Social Security cost will exceed non-interest income throughout the 75-year projection period. The Trustees project that this annual cash-flow deficit will average about $76 billion between 2015 and 2018 before rising steeply as income growth slows to its sustainable trend rate after the economic recovery is complete while the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.” [Editor’s Translation: Social Security has been in the red on a cash flow basis since 2010 and is expected to stay there forever.]

Medicare – “HI non-interest income less HI expenditure is projected to be negative this year and next (as it has been in every year since 2008), and then turn positive for four years (2017-2020) before turning negative again in 2021….” [Editor’s Translation: Medicare has been in the red on a cash flow basis since 2008. The Trustees expect a short respite starting in 2017, but it won’t be long before Medicare is back in the red again on a cash flow basis.]

“Social Security’s Disability Insurance (DI) Trust Fund now faces an urgent threat of reserve depletion….”

[Editor’s Translation: Contrary to popular belief, all three programs are pay-as-you-go. Hate to break it to you, but there are no ‘trust funds’. The programs are contributing to the deficit now and they are unsustainable in the long term, something we have known for years. Not even the fiction of ‘trust funds’ can cover up the fact that the Social Security disability program is broke. The last time it went broke, Congress ‘borrowed’ from the main Social Security ‘trust funds’ to ‘shore up’ the disability program, thus accelerating the ‘depletion date’ of the main Social Security ‘trust fund’. What chicanery are they going to pull this time and will they really expect us to believe it?]

Highlights from the 2015 Social Security and Medicare Boards of Trustees Annual Reports:

“Social Security’s total expenditures have exceeded non-interest income of its combined trust funds since 2010, and the Trustees estimate that Social Security cost will exceed non-interest income throughout the 75-year projection period. The Trustees project that this annual cash-flow deficit will average about $76 billion between 2015 and 2018 before rising steeply as income growth slows to its sustainable trend rate after the economic recovery is complete while the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.” [Editor’s Translation: Social Security has been in the red on a cash flow basis since 2010 and is expected to stay there forever.]

Medicare – “HI non-interest income less HI expenditure is projected to be negative this year and next (as it has been in every year since 2008), and then turn positive for four years (2017-2020) before turning negative again in 2021….” [Editor’s Translation: Medicare has been in the red on a cash flow basis since 2008. The Trustees expect a short respite starting in 2017, but it won’t be long before Medicare is back in the red again on a cash flow basis.]

“Social Security’s Disability Insurance (DI) Trust Fund now faces an urgent threat of reserve depletion….”

[Editor’s Translation: Contrary to popular belief, all three programs are pay-as-you-go. Hate to break it to you, but there are no ‘trust funds’. The programs are contributing to the deficit now and they are unsustainable in the long term, something we have known for years. Not even the fiction of ‘trust funds’ can cover up the fact that the Social Security disability program is broke. The last time it went broke, Congress ‘borrowed’ from the main Social Security ‘trust funds’ to ‘shore up’ the disability program, thus accelerating the ‘depletion date’ of the main Social Security ‘trust fund’. What chicanery are they going to pull this time and will they really expect us to believe it?]

- Source: Trustees Annual Report Summary

ORIGINAL ARTICLE - 'Social Security Doesn't Add to the Deficit'

How many times have we heard liberals say this? It’s a bold-faced lie. Here’s the bottom line from the most recent Social Security Trustees Report:

How many times have we heard liberals say this? It’s a bold-faced lie. Here’s the bottom line from the most recent Social Security Trustees Report:

- Social Security is in the red on an annual cash-flow basis and expected to stay there

- The picture is worsening (even if you believe in the so-called trust fund)

- Medicare is in the red on an annual cash-flow basis and has been since 2008. The trustees issued a warning

- No matter how you slice it, Medicare is in bad shape

- Obamacare ‘bends the Medicare cost curve down’ (big claim of the Democrats when they were ramming Obamacare down our throats) only if you grant highly dubious assumptions - that efficiencies will actually materialize from imagined innovations and that payment cuts to doctors will actually stick – good luck with that!